Bitcoin, The Future of Payment: What is it, and how does it work?

Bitcoin has become quite the talked about currency these days perhaps due to the ongoing pandemic. But many don’t really know what it is or how it works both questions I aim to answer in this article.

So what is a Bitcoin?

At its most basic level, a bitcoin is nothing but an alphanumeric string. By itself it has no real value and is not tied to any real world currency. Its value comes from the fact that people use it and believe in it.

Bitcoins are stored at bitcoin addresses or bitcoin wallets, which (obviously) are password protected by the owner of said bitcoins. These ‘wallets’ can be completely online or offline on a website, a computer or on a mobile phone. You can store bitcoins in say a pen drive, which is one method of offline storage of bitcoins. Bitcoins can be bought through several currency exchanges. So all in all bitcoins function just like a regular, physical currency but the difference is that most of the stuff are virtual.

So now that that’s out of the way let’s have a little history lesson…

Bitcoin was first conceived by one Satoshi Nakamoto, whose real name is still unknown, in the early 2008. He posted his model of a cryptocurrency in a mailing list ( a collection of names and addresses ), that was hosted by Perry Metzger. This mailing list was notorious due to the fact that it contained some of the best minds in programming at the time, such as the creator of PGP (Pretty Good Privacy), Phil Zimmermann. Before bitcoin there was an attempt at making a cryptocurrency done by David Chaum. In his version the records of the transactions were to be kept in a centralized ledger to prevent fraud and he even make a company called DigiCash for this but this concept didn’t work out. Satoshi’s model was different due to the fact that it uses a concept called a blockchain as a distributed method of verification (in order to prevent people from duplicating bitcoin). This method was interesting due to the fact that it is completely decentralized.

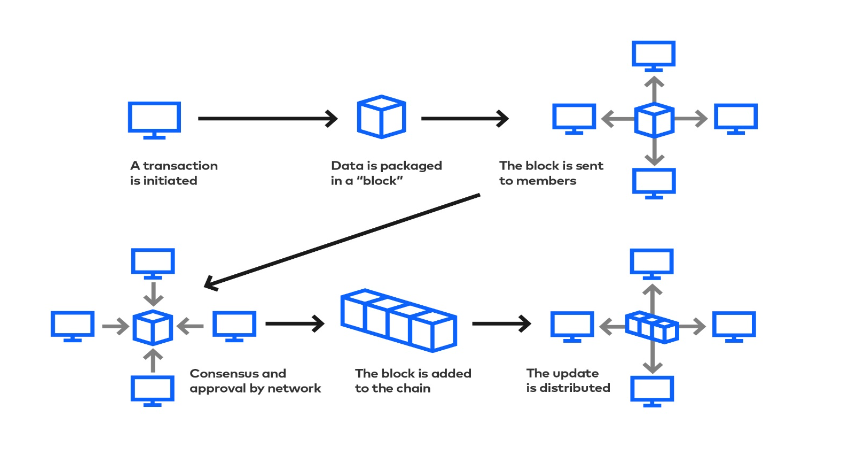

The picture above shows how the concept of a blockchain works. Every time a bitcoin transaction is done a record of it is stored in the blockchain. The blockchain is made up of blocks, with each block having around 10 minutes or so of transactions. Once a block is packaged it is sent to the network and once it is approved the block is added to the blockchain and the new change is sent to everyone in the network. The blocks follow a chronological order and each block contains a cryptographic hash, which ensures that a new block can only be added from the end of the previous block.

The blockchain has a record of every bitcoin transaction ever made and is available to everyone using the Bitcoin software. To make sure that no fraud or duplication is taking place the blockchain is constantly verified by everyone who is using the software. This allows bitcoin to be transmitted but not duplicated and no centralized system is used. Although bitcoin can be purchased or earned it is also possible to receive bitcoins by

dedicating your computing power to verifying the blockchain, AKA ‘Bitcoin mining’. Satoshi was very clear on his loyalties in his posts. He distrusted banks and governments and designed bitcoin to be peer-to-peer, encrypted and nearly anonymous, which made linking a real person to a bitcoin transaction very difficult. The blockchain may have the records of the transaction but it doesn’t record the people who did the transaction.

Furthermore, he put a limit to the number of bitcoins that can be made: 21 Million. This was done to keeps the banks out of it. Currently around 18 million bitcoins have been mined and put into circulation. In other words bitcoin takes control of the money supply away from governments. In short Satoshi is a libertarian and is against government surveillance, manipulation and control over things like the supply of money. Bitcoin was his way of undermining such governments. Transactions are secure, fast and free with no central authority controlling its price. Everyone is in charge. The closest thing that comes to a governing body is the Bitcoin Foundation. It’s a semi-official body that represents the currency and ensures that the system is working as it should.

Bitcoin was first introduced to the world in 2009. The number of people using bitcoin increased and this pushed its price from less than $0.001 in October 2009 to $100 in April 2013. Bitcoin hit $1000 after a US Federal Reserve spokesman stated that bitcoin may one day become a ‘viable currency’. Bitcoin’s rise to prominence led to a huge amount of investment, currency exchanges and even other cryptocurrencies.

It became the currency of choice for many online black markets including the famous ‘Silk Road’ market. Its value soared during the COVID-19 pandemic due to the fact that many people moved to online transactions. Following some tweets from Tesla and SpaceX founder, Elon Musk, bitcoin was pushed all the way up to its all time high of $64,899.00. However due to strict measures taken by China against bitcoin mining, the price has now falled to $32,096.83 ( as of 16/7/2021, 10.42pm local time ) Millions of dollars worth of bitcoins are traded everyday and in some parts of the world you can live almost entirely on bitcoin.

Now to the next question, is bitcoin a good investment ?

The answer is, not always. If you checked the graph above you would see that although the value of bitcoin is high, its price fluctuates wildly. Within the course of the last few months its price has gone down from $64,899.00 to $32,096.83. Almost halved. As said before bitcoins are not tied to any real world currency and does not have a real value. Its value solely depends on whether people believe in it. And what would happen once all the 21 million bitcoins have been mined? There are 2 predictions:

- Due to the supply going down to zero, its demand would rise to the sky ( the demand and supply model in economics shows this, as supply goes down, demand generally goes up ), and as demand goes up its price would also go up with current predictions going from over $100,000 to over $1,000,000.

- Due to the supply going down to zero, bitcoin may become obsolete and be replaced by other cryptocurrencies. Demand goes to zero so the price of bitcoins may crash to $0. So all in all, investing in bitcoin, or any other cryptocurrency for that matter, is risky but if you are familiar with the market and have a good grip on how the price goes then bitcoin is a very viable investment.

So to conclude, I hope that you now have a good understanding on this new currency. It is stated to be the Future of Payment but time would tell whether that may or may not happen.

YUTHIN HIMSARA

References:

http://Bitcoin Price Chart (BTC) | Coinbase